Amazing Info About How To Prevent Bad Debt

Display your credit terms clearly on.

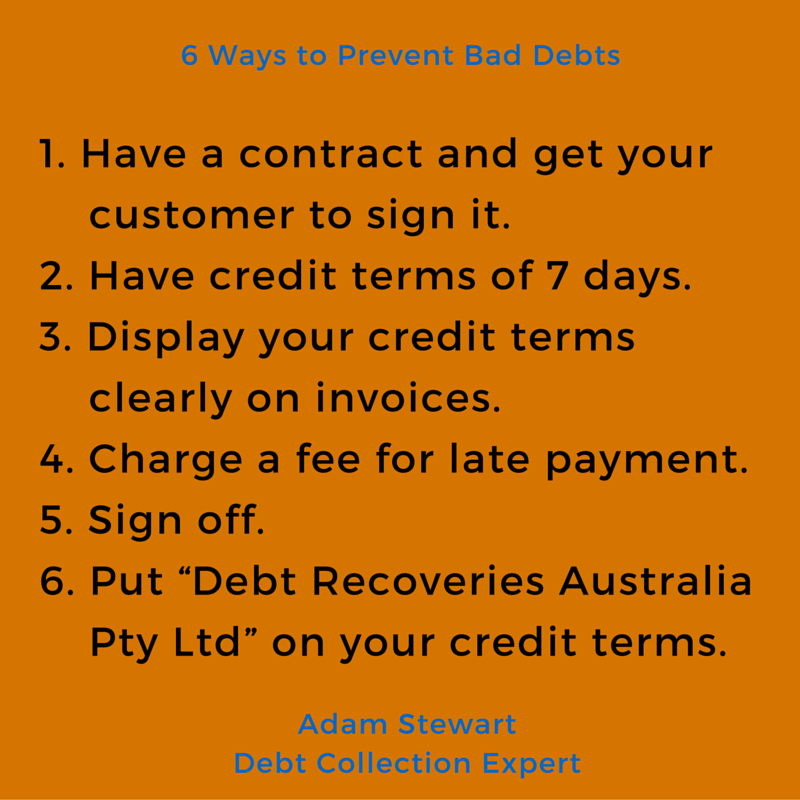

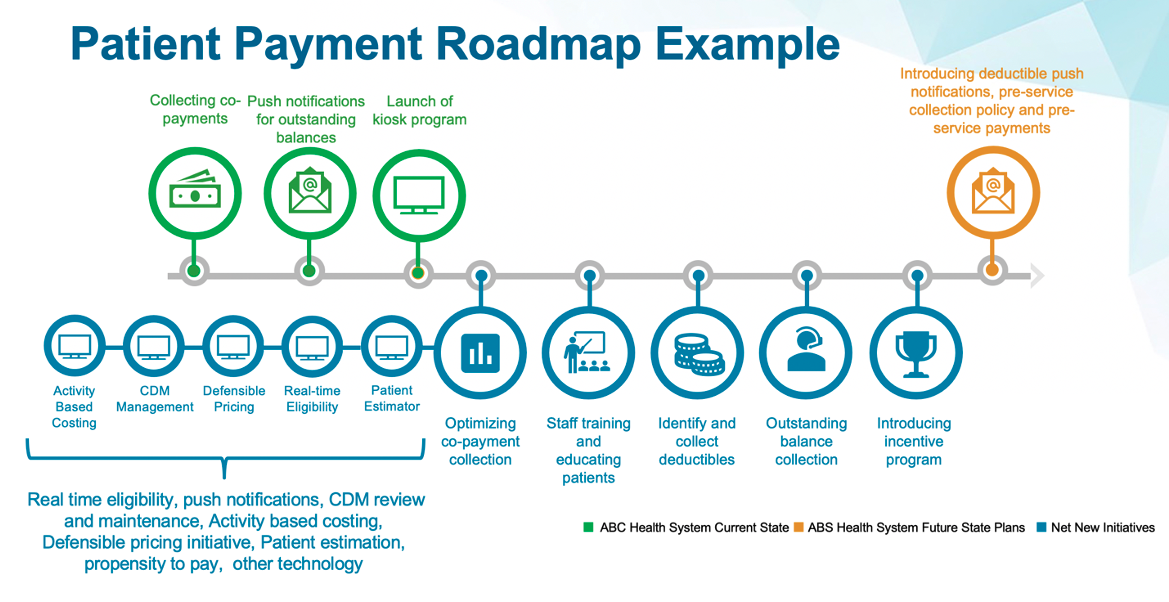

How to prevent bad debt. Here some of the important tips to avoid getting into a bad debt: How to avoid bad business debt. The steps that follow are an excellent roadmap for doing just that.

The simplest way to prevent bad debt from cropping up is to make sure your customers receive invoices promptly and can make payments easily. The sales department shall timely trace and monitor the status. Stashing away the extra money will build you a bigger cushion.

Some prefer to live without a credit card and avoid the temptation to. One of the ways to avoid the chance of bad debts is by making sure your customers have a good track record of paying their other suppliers. Although businesses may not be able to avoid bad debts altogether, you can reduce the likelihood of bad debts and decrease the total.

Avoiding debt requires sidestepping spending whims while establishing a sound financial plan. We're a trusted nonprofit offering financial counseling for over 60 years. By using coupons to minimize the cash you have to use on those needs it will free up extra money that was inaccessible before.

Ask interested customers to fill out a credit application form. How to prevent bad debts, using a good invoicing system, a good invoicing system is required to prevent bad debt. This is an important part of collecting money.

Maintain communication with customers, one of the most efficient ways to prevent bad debt is to maintain clear, repetitive communication with customers. The process involves stopping payments to creditors and then negotiating. In today’s online world, there is no excuse as to why a customer cannot pay within 7 days, no matter how much the payment costs.