The Secret Of Info About How To Apply For American Opportunity Tax Credit

When claiming this tax credit, you or your tax preparer mist complete irs form 8863 pdf and attach the completed form to the tax return.

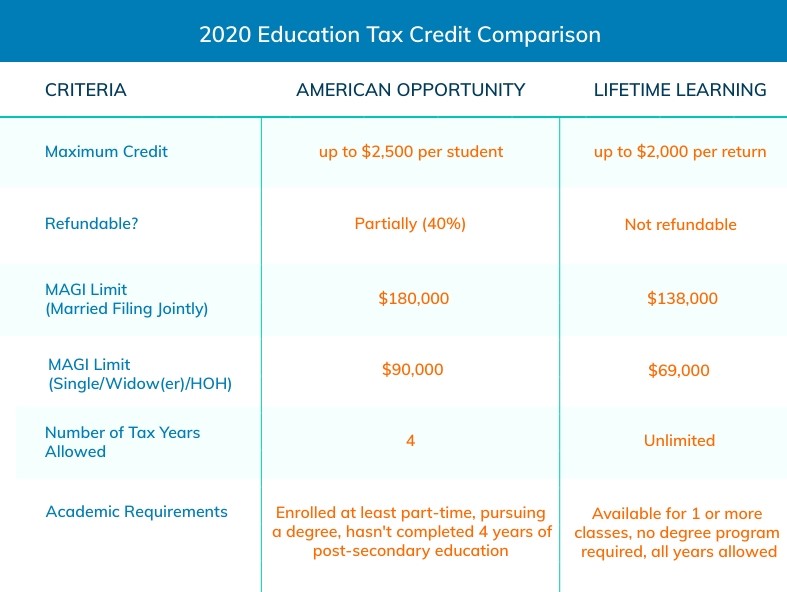

How to apply for american opportunity tax credit. Above $160,000 but below $180,000 and you’re married filing jointly. Not have finished the first four years of higher education at the beginning of the tax year. To be eligible for aotc, the student must:

Be enrolled at least half time for at least one academic period * beginning in the tax year. Medical expenses (including student health fees) room and board; How do i apply for american opportunity tax credit (aotc)?

You paid an eligible student's qualified education expensesfor higher education at any college, university, or. To claim the tax credit, complete the relevant sections of irs form 8863to calculate the amount of tax. To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040.

How do i apply for american opportunity tax credit (aotc)? Be pursuing a degree or other recognized education credential. The work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment.

“c” corporations can offset up to 100% of the corporation’s alabama income tax liability. To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your. To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your.

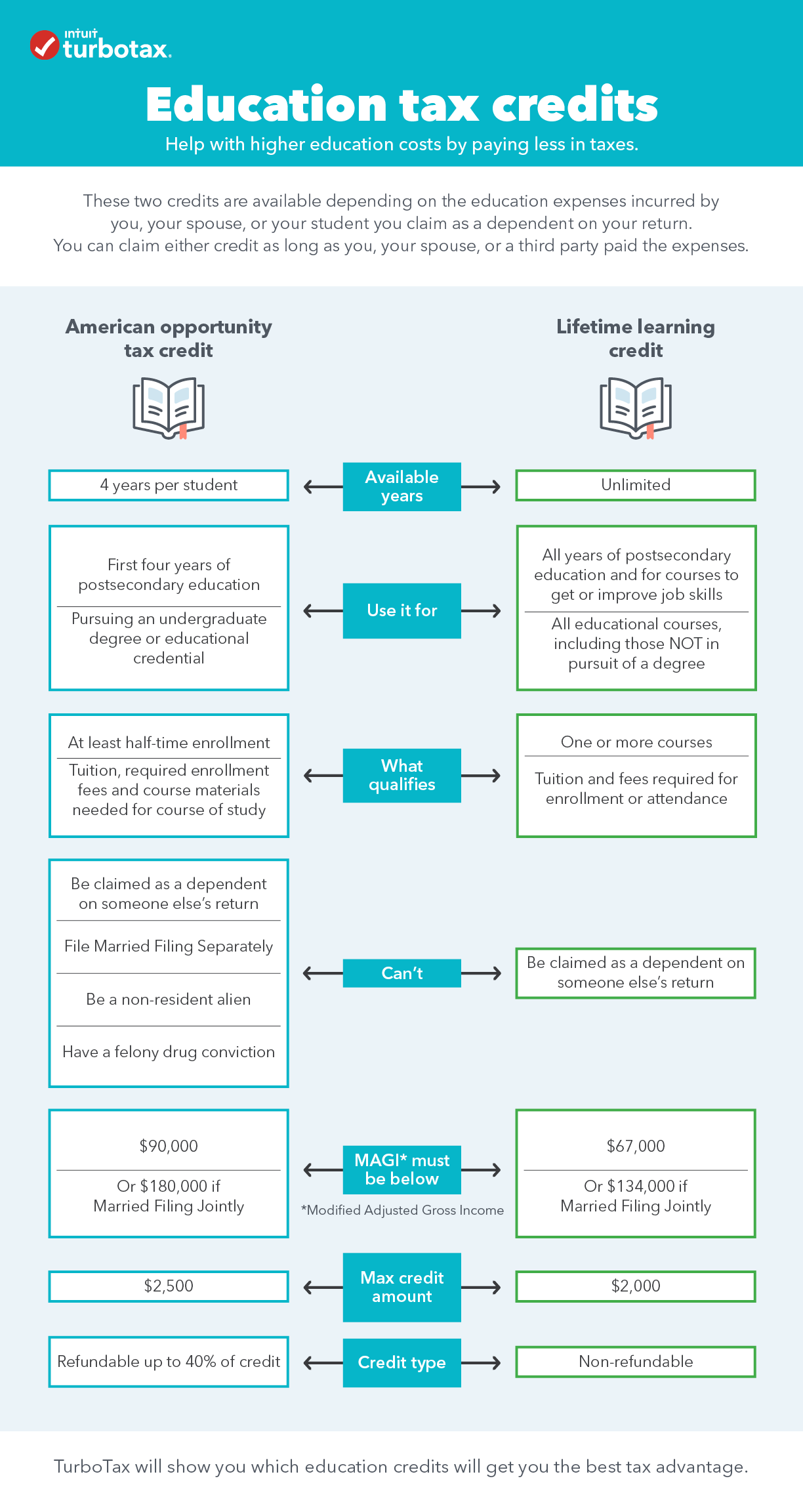

How do i apply for american opportunity tax credit (aotc)? The maximum $2,500 credit is based on $4,000 in. Qualifications for claiming the american opportunity tax credit are: